Saqib Rahim, E&E reporter. Published:

The electric car has run into several market cross winds that didn’t exist at the start of President Obama’s term, and these forces could slow or squash the car’s commercial aspirations.Since Obama took office in 2009, U.S. oil production has surged. World oil prices have spiked, then ebbed, thanks to higher world production and lagging economies. And last year, automakers signed a major pact with Obama to make cars more fuel-efficient through 2025.For electric cars, this means the nightmare scenario cannot be ruled out. Oil prices could stay low, easing car buyers’ concerns about pain at the pump. As oil increasingly comes from North America, shoppers may worry less about the source. And with fuel-efficient models getting 40, 50 or more miles per gallon, the consumer may be hard-pressed to pay several thousand dollars more for an electric.Instead of becoming the mass success Obama envisioned, electric vehicles, or EVs, may get stuck in the “niche” category.

The electric car has run into several market cross winds that didn’t exist at the start of President Obama’s term, and these forces could slow or squash the car’s commercial aspirations.Since Obama took office in 2009, U.S. oil production has surged. World oil prices have spiked, then ebbed, thanks to higher world production and lagging economies. And last year, automakers signed a major pact with Obama to make cars more fuel-efficient through 2025.For electric cars, this means the nightmare scenario cannot be ruled out. Oil prices could stay low, easing car buyers’ concerns about pain at the pump. As oil increasingly comes from North America, shoppers may worry less about the source. And with fuel-efficient models getting 40, 50 or more miles per gallon, the consumer may be hard-pressed to pay several thousand dollars more for an electric.Instead of becoming the mass success Obama envisioned, electric vehicles, or EVs, may get stuck in the “niche” category.

“Unless the regulation forces and supports and incentivizes EVs, I think they’re going to remain a niche market for some time,” said Xavier Mosquet, a senior partner at the Boston Consulting Group. “You really need $250 a barrel to really impact the adoption rate of EVs in the U.S. market, unless there is a breakthrough in battery technology.”

A $250 barrel of oil sits at the high end of oil projections for the future, but it represents how far some experts think electric vehicles have to go to compete head-to-head with gasoline cars, which cost less up front but have a pricier fuel. Batteries make EVs several thousand dollars more expensive than gasoline competitors. If gasoline prices fall, that gap widens even more.

Obama’s campaign to close that gap started in 2009, when he spearheaded a multibillion-dollar campaign to jump-start the electric car. Factories were erected to reduce the cost of batteries, research on battery breakthroughs began, and federal incentives were extended to customers.

To the White House, the appeal of electric cars was plain. Gas prices were on the public’s mind, as they had spiked and plummeted throughout 2008. Obama wanted to address climate change and establish the United States in a clean-tech industry, and he had a Democratic Congress to work with.

In addition, the enormous new oil reserves in the United States were not yet widely known; the price of oil seemed destined to creep upward forever.

The president set an ambitious goal: 1 million plug-in hybrids on U.S. roads by 2015.

As experts see it, this goal is unlikely to be met. Instead, the market seems to be shifting toward simpler, lower-cost versions of the electric car. These have stronger appeal, it is thought, as gasoline prices remain relatively low.

One example is start-stop technology, which lets a car avoid idling by using a small battery anytime it pauses. Gasoline hybrids, which use a small battery to capture energy from braking, have gained market popularity.

As automakers seek to meet federal efficiency mandates, these kinds of strategies will become common, said Dan Sperling, director of the Institute of Transportation Studies at the University of California, Davis. He said that in 10 to 15 years, the majority of cars will have some form of hybridization.

While they won’t be full electrics, he said, they will be numerous enough to make a big difference on pollution and oil.

“Then it’s recognized that if we’re going to go beyond that point … we really have to go toward electrification,” he said.

The long-term view on fuel

At least some automakers are taking that view. While they emphasize that gasoline is the fuel of today and the near future, they have now committed substantial resources to electric cars — and they want to see it succeed in the long term.

Gary Smyth, executive director of research and development for General Motors Co., has his sights on the year 2050. Between now and then, he said, large trends will take effect. Countries like China and India, which today use a fraction of the oil used in the Western world, will attempt to match it.

The goal is a fuel that is “renewable, plentiful and low-carbon,” he said. No amount of oil can solve that.

“Irrespective of the availability, I think there’s going to be intense increasing demand for oil, and no matter what, we need to look at ways of diversifying off of oil,” he said.

That explains why GM continues to produce the Chevrolet Volt, a plug-in electric car that gets 38 miles of electric range before shifting to gasoline. Several thousand Volts are sold per month — far less than GM’s gasoline models. But in the first five months of this year, the plug-in outsold the Chevrolet Corvette.

Still, some evidence suggests that in the long term, low oil prices pose a threat to electric cars. Experts tend to reference a pump price of $3 to $3.50 a gallon; below that, they say, it’s tough to see a battery that can compete.

According to the Energy Department’s latest Annual Energy Outlook, electric cars with 100 miles of range are on track to sell 2.32 million models in 2035. But in a low-oil-price case — $62 a barrel — 780,000 are sold. Hybrids like the Volt take a similar haircut.

Some point out that to get that kind of price, extreme events have to occur in the oil market. For example, in the United States, drillers would need a sustained high price to become interested in drilling. As the price dropped, they would need to continue production, driving the price down.

Moreover, the U.S. and world economies would likely have to stay weak to keep prices so low — a scenario that few foresee as a permanent state.

How much can batteries drop?

Regardless, to compete with increasingly efficient gasoline cars and face a potentially low price of gasoline, electric cars have one option: to use cheaper batteries.

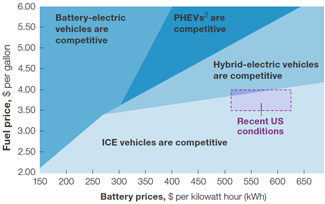

The debate is how much those costs can drop — and when. Mosquet, of Boston Consulting Group, said that batteries can fall to $400 per kilowatt-hour in the next 10 years. Still, he said that falls short of the $200 to $250 necessary for a large volume of electric cars in the United States — some 10 percent of annual auto sales, as a rule of thumb.

A recent report from consultancy McKinsey & Co., however, says the $200 mark is achievable by 2020 — and that even deeper cuts are possible by 2025. If gas prices stay at $3.50 a gallon or more, a battery price of $250 would let an electric car and a gasoline car break even, the report says.

John Newman, an associate principal at McKinsey, said electric cars can gain mass adoption if the battery prices fall — and the cars are given time.

“Even for the technologies that get adopted most quickly by the auto sector, you’re still looking at 10 years for significant adoption,” he said. “Right now, I’d say we’re at the front end of the adoption curve.”

Moreover, he said batteries are poised to draw lots of research and development funding in the coming years, largely from companies with few ties to Detroit.

Apple Inc., for example, put 25 watt-hours of energy storage in the iPad 2. The iPad 3 had 42.5 watt-hours — 70 percent more — while adding mere millimeters of thickness. “This is an industry that’s moving forward quite quickly,” he said.

Source: http://www.eenews.net/energywire/2012/08/15/1

Excellent blog! Do you have any suggestions for aspiring writers? I’m hoping to start my own site soon but I’m a little lost on everything. Would you propose starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m totally confused .. Any recommendations? Thanks a lot!

Hi there would you mind sharing which blog platform you’re using? I’m planning to start my own blog in the near future but I’m having a tough time deciding between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I’m looking for something unique. P.S Apologies for getting off-topic but I had to ask!

Fantastic goods from you, man. I’ve understand your stuff previous to and you’re just too excellent. I actually like what you have acquired here, really like what you’re saying and the way in which you say it. You make it entertaining and you still take care of to keep it smart. I can’t wait to read much more from you. This is really a great web site.