Caught between Scylla and Charybdis

The Homeric lessons of Greek mythology: A practical guide for modern Greece.

Tomorrow, June 17th, the people of Greece will cast ballots to decide the economic future of their nation. They face two very unpleasant choices.

More sacrifice and extreme budget cuts

First, their electorate can accept the austerity measures mandated by Germany, and other participants within the European Union, ensuring many lean years of slashed budgets within a stripped down national economy. Greece’s gross domestic product has withered, social programs have fallen to the axe, and low-paying jobs remain scarce, even to overqualified candidates. Their banks have had to stave off occasional runs in a stagnating market that resembles a good ol’ fashioned depression. Who would vote for more of the same?

Default on massive debt to the E.U. with new focus on domestic spending

On the other hand, Greece may decide to default on their gazillion euro debt to the European Union, dumping the euro-based economy to take their chances on a return to the drachma. Their potential departure from the euro zone could set off a series of ruptures that herald a new economic ice age for the region’s vulnerable financial markets.

Believe it or not, Sunday’s vote on the other side of the globe could actually affect your future job prospects in The States. This is a scary, complex issue with no easy answers. Nobody gets a free ride on our limping global economy. Countries that fail to manage debt responsibly compromise the fates and futures of other nations, while risking financial reprisals and new peril from free-market exile.

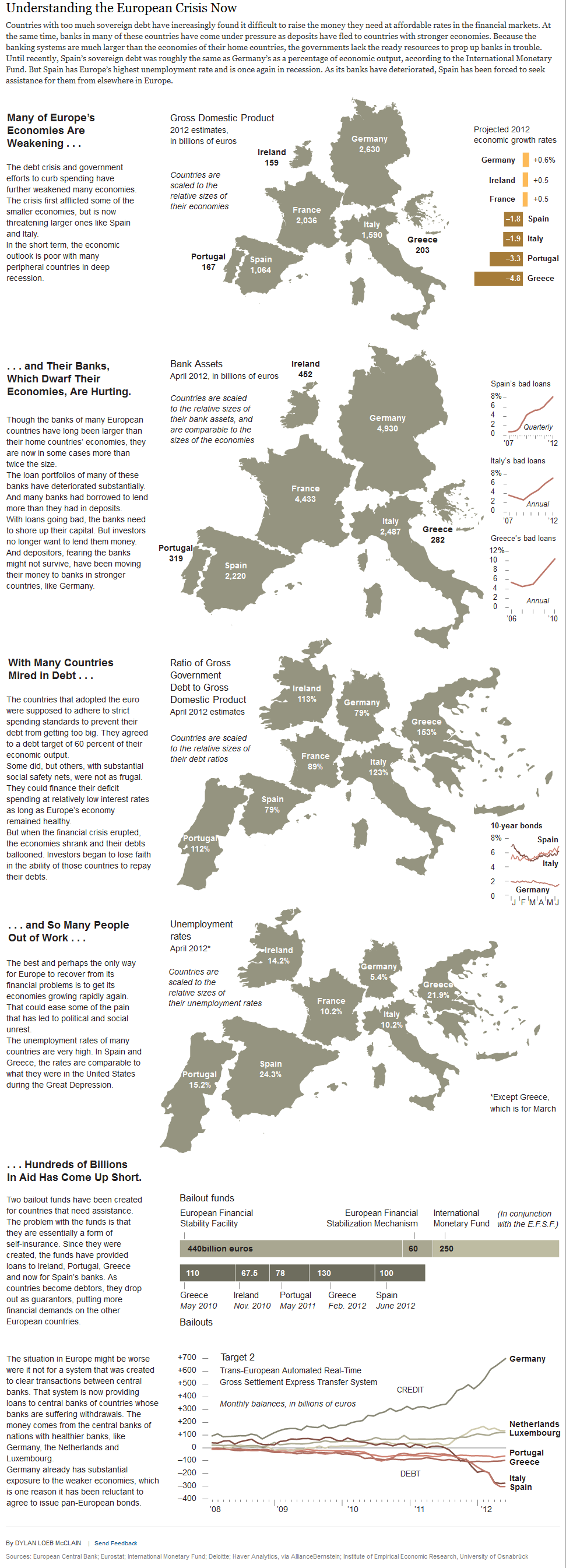

Understanding the European Crisis Now – Graphic – NYTimes.com

Rather than trying to explain this one on our own, we’ll let the New York Times’ infographic do the talking for us.

Because the banking systems are much larger than the economies of their home countries, the governments lack the ready resources to prop up banks in trouble.

Until recently, Spain’s sovereign debt was roughly the same as Germany’s as a percentage of economic output, according to the International Monetary Fund.

But Spain has Europe’s highest unemployment rate and is once again in recession. As its banks have deteriorated, Spain has been forced to seek assistance for them from elsewhere in Europe.

By DYLAN LOEB McCLAIN |

Sources: European Central Bank; Eurostat; International Monetary Fund; Deloitte; Haver Analytics, via AllianceBernstein; Institute of Empirical Economic Research, University of Osnabrück

Related articles

Greeks face a Homeric dilemma (wordscover.me)

Europe crisis spreads as Merkel resists big steps

Economically-sound Germany at risk if Greece falters (cbsnews.com)

The European countdown (bbc.co.uk)